Auditing the Federal Reserve was once part of the Trump administration’s first 100 days’ action plan to “Make America Great Again,” but it appears that Wall Street banker and Treasury Secretary nominee Steve Mnuchin is now trying to undermine President Trump and the momentum of this important campaign promise.

Over the years, Sen. Rand Paul (R-Ky.) and Rep. Thomas Massie’s (R-Ky.) Federal Reserve Transparency Act has received growing bipartisan support, even from polar opposite ideologues like Sens. Bernie Sanders (I-Vt.) and Mike Lee (R-Utah), who recognize the dangers of allowing Fed officials to manipulate the economy for political gain.

In 2014, the bill passed the House with a 333-92 vote. Although it failed the Senate by a mere 7 votes, many speculate that the “Trump bump” will allow it to hop over the legislative hurdle once and for all — that is, unless Mnuchin distances the president away from it.

Although Trump recognizes that “Auditing the Fed is so important,” so much so that he publicly called out Sen. Ted Cruz (R-Texas) for missing a vote on the bill last year, Mnuchin is quietly working to stop the legislation from advancing. When questioned last week by Sen. Bill Nelson (R-Fla.), Mnuchin said, “As you know, the Federal Reserve is organized with sufficient independence to conduct monetary policy.”

Mnuchin is merely echoing his former Wall Street cohort’s talking points, and it’s important that we debunk them now before further damage is done to this important cause.

The Fed does not operate ‘independently’

The Federal Reserve has become nothing more than another arm of the executive branch, responding to the beck-and-calls of the president.

As economics scholar Robert Weintraub detailed, Fed policies almost always change to reflect the monetary views of the president. For example, when he was head of the Fed, William McChesney Martin complied with President Eisenhower’s request for very slow growth in the money supply. Years later, however, Martin then agreed to reverse course by cranking up money growth to 5 percent for President Lyndon Johnson, who depended on massive Fed inflation to finance his “Great Society.”

The same held true under Fed Chairman Arthur Burns. A former vice president of the Dallas Fed said that, “The diary [Burns] kept during the Nixon years confirms that Fed policy became subservient to administration goals and the president’s re-election campaign.”

Things have not improved in recent years. In fact, this past election cycle, the “apolitical” employees of the Federal Reserve doled out over four times more in campaign donations to Hillary Clinton, who was widely speculated to win the presidency, than any of the other candidates combined.

So no, the Fed does not act independently — its members only do what is politically and personally convenient. Only a thorough Congressional audit can stop this cozy relationship between the president and the central bank.

The Fed is not thoroughly audited

Critics such as Mnuchin and Sen. Bob Corker (R-Tenn.) often argue that this bill is useless because the Fed is already thoroughly audited. This claim is far from the truth.

Currently, the Government Accountability Office, the independent, apolitical government agency tasked with auditing the Fed, is not allowed to touch the central bank’s monetary policy deliberations, FOMC transactions, and agreements with foreign central banks.

In a testimony to Congress, the GAO expressed how the audit in its current form is virtually futile because it does not allow them to adequately determine where our money is going. The Office stated, “We do not see how we can satisfactorily audit the Federal Reserve System without authority to examine the largest single category of financial transactions and assets that it has.”

In 2011, Congress ordered a limited, one-time GAO audit of Fed actions during the subprime crisis, and the results were far from pretty. That audit uncovered that the Fed lent out a whopping $16 trillion to domestic and foreign banks during the financial crisis without congressional approval.

What is the Fed doing today?

What assets has the Fed bought since then and who is it doling out money to now? The answer to these questions will remain unanswered unless Congress passes Paul and Massie’s Audit the Fed bill this session.

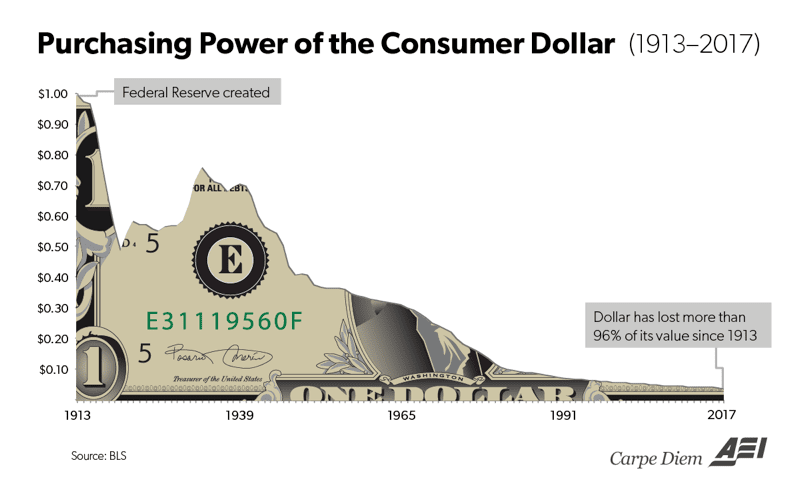

Allowing the Fed to rapidly inflate the money supply and secretly give out loans to foreign entities without congressional oversight is stupid policy. It has destroyed 95 percent of the dollar’s purchasing power, all for the purpose of helping the president and his favored Fed officials retain political power.

Let’s hope that President Trump, who has promised to “drain the swamp,” sees through the light of Mnuchin’s talking points and prioritizes the passage of this bill. The economy can’t be made “great again” without doing so.

Source: Will Mnuchin stop Trump from auditing the Federal Reserve?